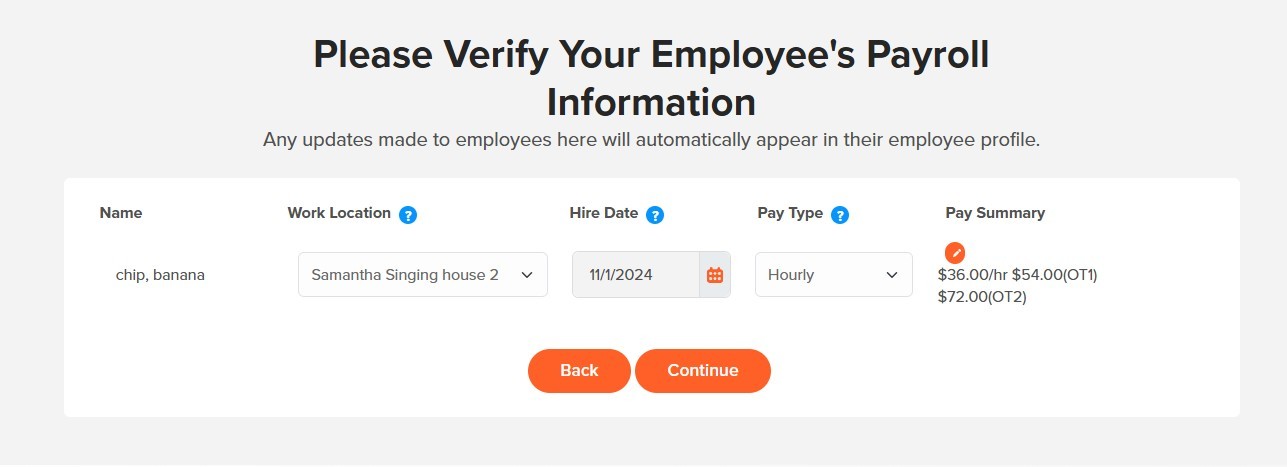

The next step for enrollment is to verify (and enter) details for each of your employees:

- Work location

- Hire date

- Pay type (hourly or salaried)

- Pay rates

If you chose to assign the location to all employees from the previous step, the work location should be filled in already. If it is blank, or not correct, please enter the correct work location.

Enter or confirm the hire date for each employee and assign them as hourly or salaried.

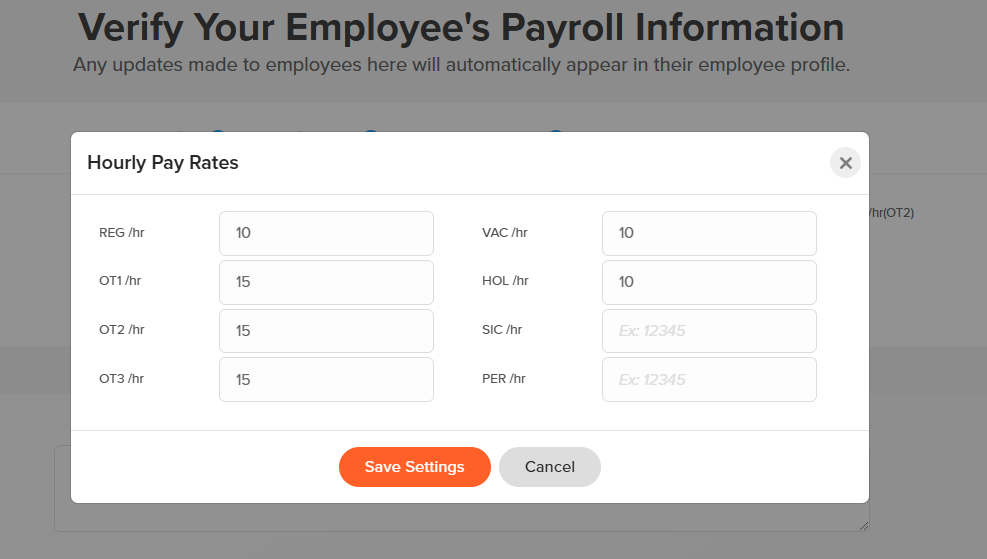

Choose the pencil icon and edit the pay rate for each employee. All fields displayed must have a value.

NOTE: the purpose of this step is the initial creation of the employee profile in the payroll system using the employee records already in your OnTheClock time tracking account. You are being asked to add or verify hiree dates and pay rates, as those were optional fields in tracking time. They are necessary for running payroll and completing this steps starts the process of creating the payroll employee record.

After completing this initial verification of employees during enrollment, you will make any employee changes (like changes in pay) by editing the employee in the Employees tab.

![]()